Qualify for Cyber Insurance with Confidence

Insurers now expect strong identity controls, not just good intentions. With AuthX, you’ll meet insurer security standards, lower your premiums, and protect your brand.

Why Cyber Insurance Is No Longer Optional?

Cyberattacks aren’t just security issues anymore, they’re financial liabilities. In 2024 alone, the average cost of a data breach reached $4.88 million (Forbes), and incidents affected over 343 million victims worldwide. With insurers tightening coverage criteria, having cyber insurance is no longer enough, you need to qualify for it.

AuthX helps you prove to underwriters that your organization has robust identity protection in place. From phishing-resistant MFA to continuous session monitoring, we make sure your IAM stack checks every insurer box.

What Underwriters Look For, and How AuthX Helps You Meet It!

Modern insurers have evolved their questionnaires. They’re no longer satisfied with basic password policies or SMS-based MFA. Today, carriers evaluate whether you have:

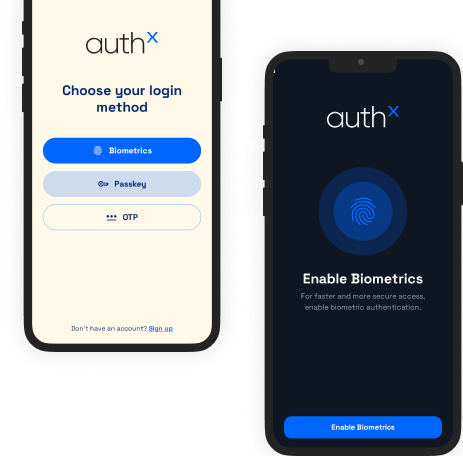

Phishing-Resistant Authentication

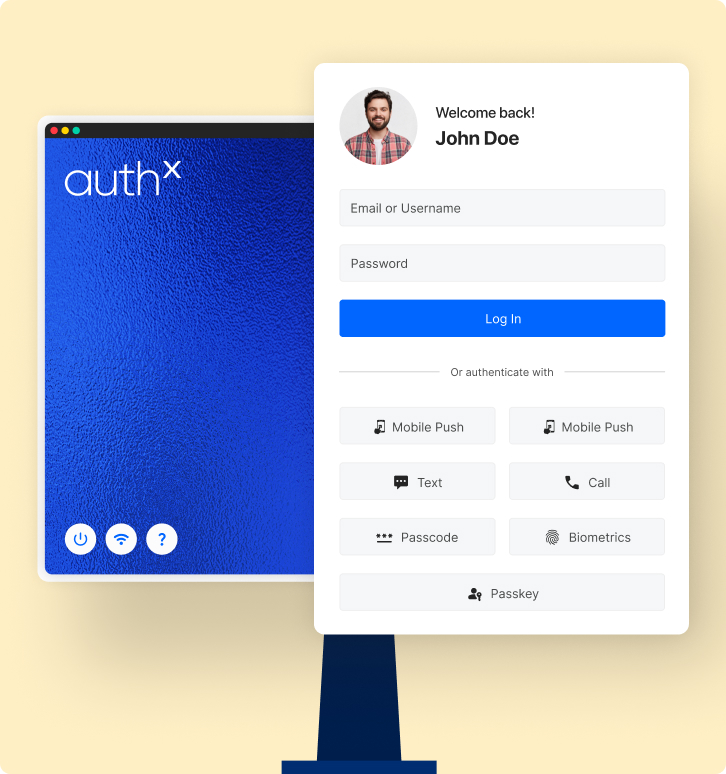

Passwordless logins, passkeys, biometrics

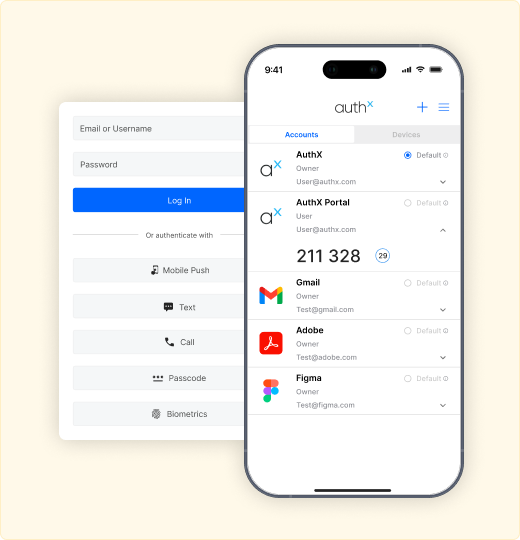

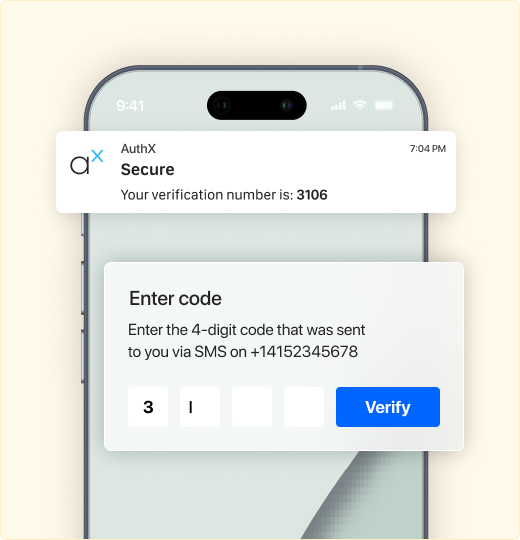

Full MFA Coverage

Comprehensive MFA coverage across all users, endpoints, and devices

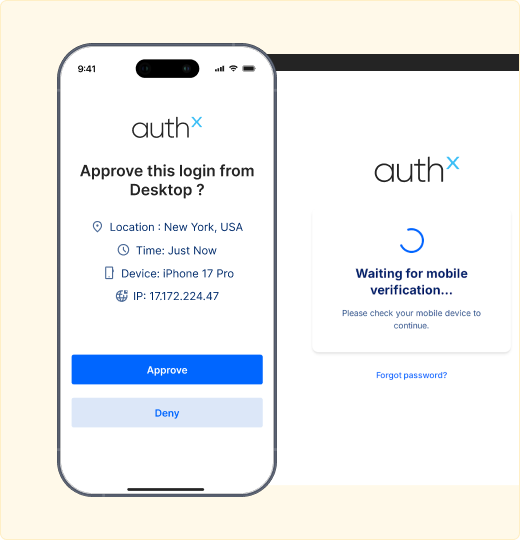

Session Monitoring

Continuous authentication and behavioral analytics to detect session hijacking

Least privilege access

Least-privilege access management to limit blast radius

Identity Governance

Centralized identity governance for audit and reporting

AuthX maps directly to these insurer requirements. Our identity and access management platform strengthens every touchpoint of user authentication, helping you demonstrate compliance with even the strictest underwriting standards.

How AuthX Makes You Cyber Insurance–Ready?

Getting insured shouldn’t feel like running an audit marathon. AuthX simplifies compliance by making modern IAM effortless to deploy and document.

Passwordless Authentication

Eliminate password vulnerabilities with passkeys, biometrics, and badge-tap login.

Invisible MFA

Move beyond traditional codes with contextual, risk-based authentication that protects users without friction.

Continuous Authentication

Monitor risk signals throughout user sessions to prevent compromised logins mid-flight.

Seamless Integration

AuthX fits into your existing tech stack without workflow disruptions or retraining your users.

With AuthX, you don’t just deploy security, you prove it. That’s the difference insurers care about.

Turn Security into Savings

Strong identity protection does more than reduce breach risk, it directly impacts your bottom line. Insurers are rewarding proactive organizations with lower premiums, broader coverage, and fewer exclusions.

Lower Premiums

Meet advanced authentication standards and unlock insurer discounts.

Complete Coverage

Qualify for full protection without policy carve-outs.

Reduced Non-Renewal Risk

Stay compliant as standards evolve, ensuring your policy remains active.

Improved Risk Posture

Minimize identity risks with layered authentication that blocks unauthorized access.

Simply put, insurers trust companies that take identity seriously. AuthX helps you become one of them.

Protect Your Brand and Customer Trust

Get Cyber Insurance Ready with AuthX

Schedule a Demo or Talk to a Security Specialist

You’ll walk away with:

- A readiness checklist aligned to insurer expectations.

- A clear roadmap to compliance.

- Documented proof of IAM maturity for your underwriter.